Knowledge Hub

Finance 360o

Embedded Finance is changing the world: Explore the possibilities

There's a quiet revolution as new finance propositions become the norm for non-finance companies. Red Badger works with brands and platforms to embed finance in their everyday journeys and has a front row seat.

As financial products converge with Customer Experience, new value has emerged for retailers, software companies, services and marketplaces, alongside the banks and fintechs that supply them. This powerful shift is creating real world opportunities for your business.

What is Embedded Finance?

The integration of financial services - such as payments, lending, and banking - into non-financial platforms, products, and services. Businesses are able to embed seamless, customised finance offers within existing customer journeys without their customers needing to interact with traditional financial institutions.

For example a retailer embeds credit options on its product pages and offers flexible payment options at checkout. Now customers complete purchases without interrupting their journey or experiencing friction. A services business, such as accountancy or business critical software, offers financial products to enable frictionless payments flows to its customers. A marketplace offers sellers and buyers faster, more flexible acquisition, lending, and deposit functions.

As financial services become integrated into everyday customer experiences, companies across industries - from retail and hospitality to utilities, telcos, services and beyond - engage and transact with their customers in new ways. This trend is set to grow rapidly as customers love the ease, usefulness and affordability.

New value

Embedded Finance is reshaping the way customers discover, choose and transact financial products. The brand or service that owns the customer journey is able to capture and monetise a portion of each financial transaction.

Customers no longer need to travel to a bank to borrow or deposit, as seamless technology now wraps the provider. This is well understood for integrated payments but the opportunity for new revenues, for easier and cheaper customer acquisition, and for stickier relationships often remains untapped.

Embedding financial products, whether lending options on product pages, savings integrated to loyalty, splitting payments or deposit interest, all offer participants a share of the value created across the chain.

What does this mean for your business?

Red Badger's experience spans all types of businesses building new revenue streams, expanding into adjacent markets and renewing customer propositions.

For Retailers and Distributors:

For those that already hold a relationship with customers, possibly investing heavily to acquire them, you now maximise their experience with new offers and easier ways to buy or fund purchases.

By removing friction you stop them jumping to competitors or into other journeys to meet their needs. Your conversion rates, stickiness, basket value and lifetime value all increase.

Offer new, compelling customer value

. Unlock new profit pools

Drive enterprise valuation

. Service more demand

Create stickier relationships

Make it easier for customers to buy

For Marketplaces:

Where your business offers services to buyers, sellers and other market participants, you act as an aggregator, a place to meet and exchange. You already hold meaningful financial relationships to acquire funds, process payments and returns etc.

Your streamlined seller and partner onboarding can be leveraged with a full suite of one-stop-shop financial services, while buyer options are expanded.

Offer new, compelling seller services

. Unlock new profit pools

Extend existing relationships

. Deepen ties and connections

. Protect from disruptive competition

Enable platform services and offers

For Software and Services:

Your product will streamline business operations of customers and may have industry or function specific journeys customers have baked into their everyday workflow. From here you can extend to finance flows and follow in the footstep of the most successful SaaS providers by maximising profit and enterprise value by offering compelling, relevant financial offers in context.

Create new acquisition paths

. Unlock new profit pools

Increase customer engagement

Reduce churn

Increase lifetime value

Increase valuation multiples

Enable Platform services and offers

Originators and Distributors

Red Badger has extensive experience with Originators and Distributors, including retailers, software companies, and marketplaces.

We help these businesses embed financial services into their platforms, unlocking new revenue streams, reaching new customers, and revitalising products and services.

Fintechs

Red Badger helps FinTechs scale by driving innovation in embedded payments, lending, and financial services.

We work with both legacy institutions and new players to create financial solutions, build new platforms that seamlessly embed financial services into their clients' customer journeys.

Balance Sheet Providers

Banks and balance sheet providers are evolving beyond traditional models to embrace embedded finance.

Red Badger partners with financial institutions to explore strategic, embedded finance opportunities on adaptable and scalable platforms.

Shaping the Future of Embedded Finance

John Godfrey, Commercial Director at Red Badger, brings a wealth of experience driving commercial growth and innovation through digital transformation. Starting his career at the Bank of England and with a background in deploying strategic change across fintech, professional services, banks and retail, he's witnessed the evolution of Embedded Finance and Banking-as-a-Service (BaaS). At Red Badger, John has cemented cross-industry partnerships to help clients unlock new revenue streams and drive exceptional experiences and propositions.

Here, John shares his insights on the impact of Embedded Finance and its role in shaping the future of financial services.

How transformational has embedded finance been?

Embedded finance is revolutionising how financial services are integrated into customer interactions, allowing non-financial businesses to offer services like payments or lending seamlessly. For merchants, this means creating frictionless experiences, such as offering Buy-Now-Pay-Later (BNPL) options at checkout, which drive customer spend and deepen relationships through personalised insights. Globally, embedded finance has streamlined once-complex processes and offers finance at point of need, enhancing convenience and boosting customer loyalty. Despite its relative infancy, it has proven transformative, particularly in offering businesses diversified revenue streams and stronger customer relationships. However, many companies, from retailers and service providers, to software vendors, have yet to fully capitalise on this opportunity.

How pivotal can embedded finance be to future growth?

Embedded finance is set to be a key driver of business growth and innovation, enabling companies to offer financial services in new and efficient ways. By embedding these services directly into digital experiences, businesses create more interconnected customer experiences, unlocking new revenue streams and increasing loyalty. As finance and Customer Experience (CX) converge and barriers fade, embedded finance will become the norm, enabling businesses to access previously locked-down value pools and markets. Financial institutions are increasingly focusing on Banking-as-a-Service (BaaS) and embedded finance to offer these new growth opportunities to those that are closest to the customer demand.

How can companies adapt their business models to leverage embedded finance?

To successfully exploit embedded finance, businesses should evolve their models based on customer needs. Embedding financial services at logical touch-points within customer journeys enhances convenience, drives engagement, and creates opportunities for personalised offers. In this way, businesses gain insights and deepen relationships, using customer data to anticipate demand and shape personalised offers. As a result, companies develop more meaningful relationships with their customers while expanding their revenue streams through targeted, data-driven offers that benefit customers. Successful implementation requires a focus on rapid time-to-value, and judicious selection of platform and enabling partners.

What barriers are hindering adoption?

Adopting embedded finance can seem daunting for businesses that have traditionally created customer value without enabling financial transaction. For instance, where payments is seen as a cost to be born, rather than an asset to be explored. It can seem complex and effortful to design and deploy new customer propositions and expand in-house solutions, especially those that rely on access to financial infrastructure, regulatory approvals, and banking licences. However, partnerships with fintech companies offering BaaS and embedded finance radically simplify this, accelerating time-to-market and allowing businesses to focus on maximising their core customer value. Such partnerships enable quick integration of financial services, helping companies meet rising customer expectations for seamless, convenient financial experiences. Across the financial services sector, institutions are prioritising these service offerings making them easier to implement and competitive.

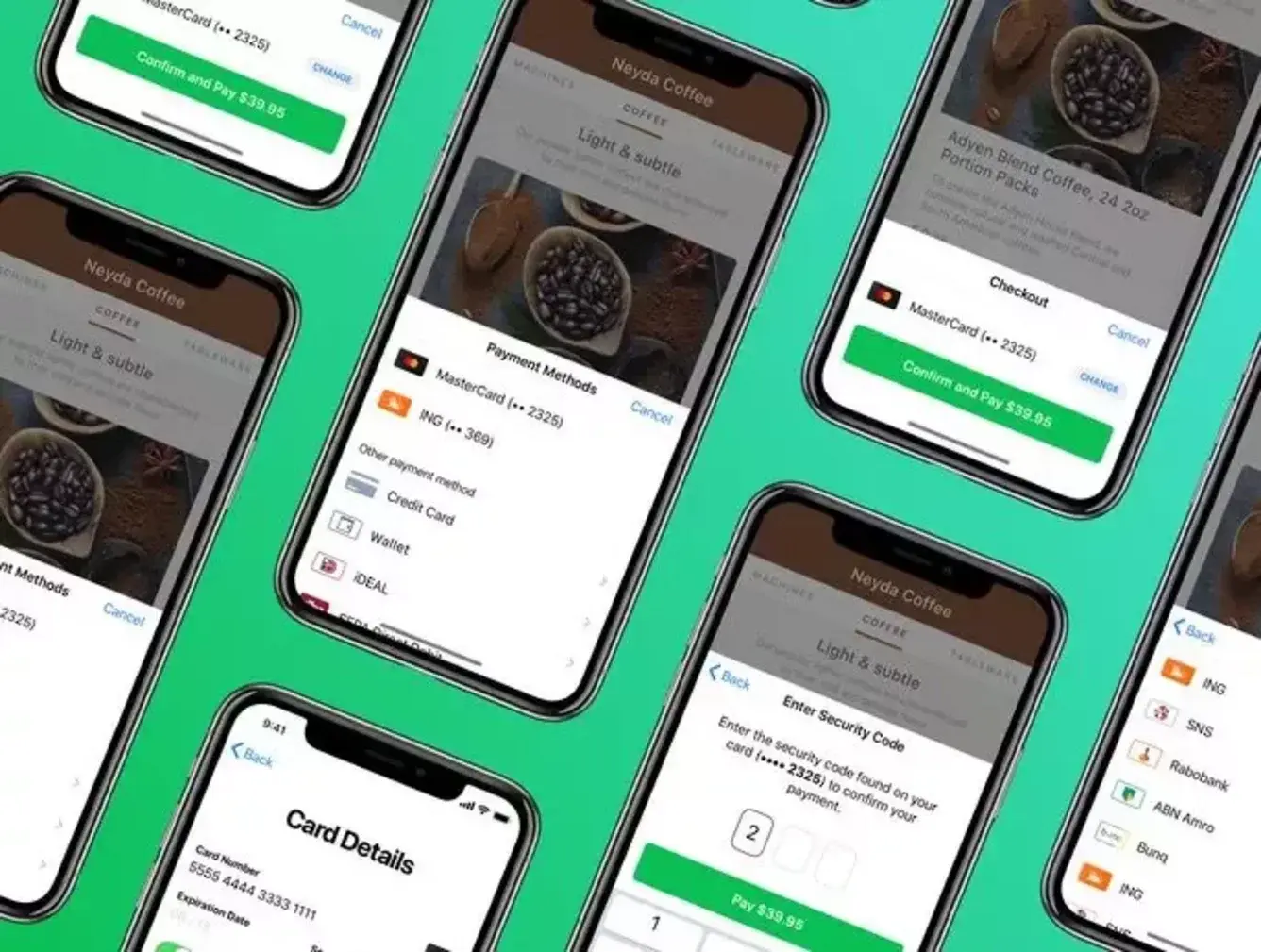

Adyen for Platforms pathway to value for embedded finance

The key to leveraging Embedded Finance successfully lies in two key areas; knowing how to build an effective go-to-market; and, selecting a technology provider that offers you full product availability and support through the regulatory and technical requirements of offering financial services.

Red Badger has for over a decade built powerful, customer- and user-centric products and capabilities for some of the biggest finance and D2C brands in the world, including J.P Morgan, HSBC, Selfridges, Levi’s.

It’s this experience that has led us to partner with Adyen, a business that delivers frictionless embedded payment and finance technology to over 8,000 businesses globally, including seven of the ten largest U.S. internet companies, including Facebook, Uber, Airbnb, Netflix, Dropbox and Booking.com.

While there are many embedded finance providers, Adyen is uniquely situated due to its array of global banking licenses and dedicated customer success teams.

We believe Adyen’s future-proofed approach to regulation, use of best-in-class technology, and diligence towards enablement is closely aligned with our own values.

Red Badger is one of just two certified Adyen for Platform enablement partners, globally. Our experience in helping retailers and distributors, marketplaces, and software businesses navigate the journey to embedded finance enablement helps to make the complex, simple. Cutting through the noise to give business leaders the confidence to begin capitalising on the commercial and innovation opportunities made possible by embedded finance technology.

Keen to explore what it means for you?

Register now for a Personalised Embedded Finance Deep-Dive

How suitable is Embedded Finance for your organisation?

Our Favourite Embedded Finance Resources

How to build loyalty programmes retail customers actually want

Consumers are switching brands at alarming rates. Building a well-designed loyalty programme can help retailers mitigate uncertainty.

Red Badger & Adyen: Empower the growth of your platform

Revolutionise payment platforms with Red Badger & Adyen. Scale your growth with seamless integration, secure transactions, and continuous innovation.

Transforming Platform Business with Adyen for Platforms

Unlock the secrets of platform success with Adyen for Platforms. Discover how innovative financial technology solutions drive growth, streamline operations, and empower businesses to thrive in the digital marketplace.

Sophisticated Payment Functionality is Easier Than Ever Before

Transform payments into a powerful business asset. Discover how modern platforms like Adyen simplify the process and drive significant business value.

Adyen for Platforms: A Guide to Integrated Payment Solutions

Red Badger's partnership enhances payment capabilities for digital platform and marketplace businesses.

Power Small Businesses with Integrated Financial Solutions

Integrated financial solutions to access capital quickly and manage finances effectively is a huge win for small businesses. Adyen's embedded solutions bring banking services to all.

Building a Marketplace for Producers: Lessons from Wylde Market

Key lessons on building a successful marketplace for producers. Discover insights on understanding needs, simplifying processes, and balancing complexity with usability.

Payments Data to Drive Revenue in the Sports Industry

Discover new ways for unified data in the sports industry to drive revenue and fan loyalty with insights from PayServe's Co-founder. Personalised, always available experiences are the future key to success.