BlogPost 206876057704 Red Badger and Sitoo Partner to Accelerate Unified Commerce for Retailers

BlogPost 206755943791 Rebecca Glassby to lead Red Badger’s Strategic Hub in Cape Town

BlogPost 206215819393 Engineering Culture: The Hidden Operating System for Scaling Success

BlogPost 201185875504 Reflections from Red Badger's 2025 Partner Day

BlogPost 198816103528 Is customer-first transformation in insurance unavoidable?

The benefit of putting the customer first is clear, however, delivering on this promise in the complex world of insurance is anything but simple.

Jimmy Taylor

Oct 31, 2025

BlogPost 197378028634 The Experimentation Gene: Turning Personalisation from Tactic to True Customer Value

Personalisation is now a core business strategy - how to break silos, scale empathy, and drive lasting customer value in retail & hospitality.

Rachael Rea-Palmer

Oct 10, 2025

BlogPost 193631555634 Red Badger's Design School Returns to Engage Next Generation of Digital Leaders

BlogPost 192472738063 Red Badger expands Enterprise Solutions Capability with Strategic Leadership Hire

BlogPost 191805559084 Earning Devotion: The Evolving Challenge of Customer Loyalty In Retail

BlogPost 191086326319 Red Badger hires former John Lewis Head of Product to lead Retail & Hospitality practice

BlogPost 191001050245 Red Badger partners with London Business School

BlogPost 189548330518 Retail Visionaries

The importance of innovation to deliver modern retail success. Now is the time to innovate online, offline and back-office functions.

Red Badger Team

May 1, 2025

BlogPost 185752077158 Celebrating Equipmii: A Game-Changer in Inclusive Shopping

BlogPost 185028228677 Red Badger hires Houses of Parliament CIO to lead new Public Sector practice

BlogPost 182985697858 Five Lessons Learned from Implementing OpenTelemetry

BlogPost 183056183639 RED BADGER'S INNOVATIVE SOLUTIONS HIGHLIGHTED AT COP29 IN BAKU

BlogPost 177953041446 Breaking the mould - How big corporates can select top tier partners

BlogPost 177591522921 Embedded Finance - The Next Profit Frontier

BlogPost 177600206141 Creating Flexible, Innovative Financial Platforms

BlogPost 177599235350 Ensuring Security and Compliance with Embedded Finance

BlogPost 177596669516 Enhancing Merchant Experience with Embedded Financial Services

BlogPost 177594597561 Simplifying Global Expansion with financial technology partners

BlogPost 177598251689 Leveraging Data Insights for Strategic Growth with Embedded Finance

BlogPost 176020802897 Red Badger and Civo Partner to Revolutionise Cloud Computing with Advanced Kubernetes Solutions

BlogPost 175091322498 Red Badger Sponsors the Individual Category at the OpenUK Awards 2024

BlogPost 175085966918 Carbon efficient high density enterprise workloads with scale-to-zero WebAssembly

BlogPost 172913390216 Payments Data to Drive Revenue in the Sports Industry

BlogPost 172913390343 Building a Marketplace for Producers: Lessons from Wylde Market

BlogPost 172913390403 Power Small Businesses with Integrated Financial Solutions

BlogPost 172912711824 Sophisticated Payment Functionality is Easier Than Ever Before

BlogPost 172596604740 Red Badger and Tuum Join Forces to accelerate finance innovation.

BlogPost 162108798249 The Pitfalls of High-Volume Transactions

BlogPost 163259242270 The Importance of Customer Loyalty in Today's Market

BlogPost 162019390778 Scaling Internationally: More Than Just A Copy Paste

BlogPost 162011754842 Adyen for Platforms: A Guide to Integrated Payment Solutions

BlogPost 163241158483 The Role of Technology in Overcoming Cross-Border Retail Challenges

BlogPost 161973683204 Red Badger & Adyen: Empower the growth of your platform

BlogPost 162011014452 Crafting Inclusivity Through Digital and Physical Accessibility

BlogPost 162008203955 The Lasting Impact of Brexit on Global eCommerce

BlogPost 159361644809 The Convergence of Physical and Digital Accessibility in Retail

BlogPost 162102214782 Red Badger and CADA Design on the Frontline of Accessibility

BlogPost 157811818010 Navigating the Future of Global eCommerce

BlogPost 159332192912 Our Cross-Border Retail White Paper

BlogPost 156708616817 Red Badger to Speak at Rust Nation 2024

BlogPost 147809893971 Mapping the Future of Sustainable Digital Products

BlogPost 145595634311 Revolutionising Retail: How Super Payments is Changing the Game

BlogPost 144727981991 Exploring the Sustainability Challenges in Finance

BlogPost 143727084393 Efficiency by Design: The Sustainable Future of Digital Infrastructure

BlogPost 143071267423 How Tap to Pay is Changing Retail, Featuring Adyen and Sweaty Betty

BlogPost 144733633795 A Roadmap for Stitching Loyalty into the Digital Fabric of the Fashion Industry

BlogPost 143683823774 The Power of Green UX: Nudging Users Towards Sustainable Choices

BlogPost 139082703216 Why Adyen's Issuing Technology is a Strategic Fit for Online Travel Retailers

BlogPost 139038551966 The Evolution of Digital Payments - What is Issuing?

BlogPost 136387977303 Cogo: Combining AI, Green Engineering & Finance for a Sustainable Future

BlogPost 136581558362 The Future of Product Management? The blend of AI and Human Intelligence

BlogPost 136580723058 How AI, Rust, and WebAssembly Are Shaping the Future of Coding

BlogPost 134901544820 AI and Financial Services: Digital Innovation with Red Badger & Split

BlogPost 131663768125 Retiring React Native in Favour of Rust

BlogPost 130654830774 Red Badger & Cogo: Championing a Greener Digital Future

BlogPost 131151518086 AI: Better code for Better Digital Experience

BlogPost 131668187680 React Native Vs Rust

BlogPost 128017125004 Red Badger is proud to be a sponsor at the OPEN:UK Awards 2023

BlogPost 123364804981 Delivering Seamless Customer Experience in the Energy Sector

BlogPost 128113005347 Rust & CRUX: The Future of Sustainable Enterprise Software Development?

BlogPost 126729428022 How is Generative AI Transforming Product Development in Blue Chips?

BlogPost 125564188291 Can Generative AI and Green Engineering Boost Loyalty in Blue Chips?

BlogPost 125454642796 Green Engineering by Design: The Future of Sustainability in Tech

BlogPost 125301052495 AI for Customer Experience - Event Follow up

BlogPost 124339409503 Responsible AI: The Key to Sustainable Growth?

BlogPost 123714982942 Red Badger and Split: A Partnership for Sustainable Digital Product Development

BlogPost 124285283872 Ethical AI: Reflections on Responsible AI, Sustainability, & Innovation

BlogPost 123756898446 A Transformative Digital Platform for Exam Providers Globally

BlogPost 124998309762 Brewing the Future: How Generative AI is Changing Beer Production

BlogPost 125250394682 AI in Digital Products - Our Tech and Product Directors discuss...

BlogPost 122674686291 Embracing Rust for Sustainable Enterprise Transformation

BlogPost 124992291212 Responsible AI: Pathways to Sustainable Growth with Dr Chris Brauer

BlogPost 122329786931 Red Badger Partners with Dr. Chris Brauer and SYMMETRY for Enterprise AI Innovation and Transformation

BlogPost 124336817554 Navigating Challenges in AI Development

BlogPost 121606988903 Transforming Customer Experience: The Role of Responsible AI

BlogPost 162127747482 The Changing Nature Of Cloud Native Ledgers In The Finance World

BlogPost 119026831782 Exploring Rust: A Sustainable Approach for Enterprise Application Development

BlogPost 119063657331 Our Top 10 Takeaways from Money 20/20 so far

BlogPost 118832471334 Embracing Rust for Enterprise Application Development

BlogPost 121867169959 Bridging Innovation and Customer Experience: The Power of AI

BlogPost 118125230877 Red Badger and Split to host LeadDev Conference After Party

BlogPost 116411032709 Rust Foundation Welcomes Red Badger to Champion the Use of Rust in Enterprise

BlogPost 116583321134 The Future of Money: Red Badger Gears up for Money 20/20

BlogPost 116391433250 The Journey Towards Sustainable Fashion

BlogPost 116560258119 Discussing our Nando's collaboration at BIMA Round Table Event

BlogPost 113883578517 How a Sustainable Codebase Can Cut Enterprise Costs and Carbon

BlogPost 111683753373 Red Badger Announces Partnership with Contentful

BlogPost 113283240632 The Changing Nature of Consumer Demand: How Sustainability is Shaping the Future of Fashion

BlogPost 113299475742 Consumer-Driven Fashion: How Brands are Meeting Customers' Expectations with Technology

BlogPost 113289326377 Blending Sustainability and Profitability: How Brands are Balancing Both

BlogPost 110666400031 Pioneering Digital Solutions for Social Mobility and Equal Opportunity

BlogPost 109800761727 How businesses can use data to understand their customers better

BlogPost 109616040351 Using payment data to unlock customer insight

BlogPost 109309050405 Event Roundup: Strategies for Seamless Customer Experience

BlogPost 109118723990 Strategies for creating seamless customer experiences

BlogPost 106883916041 Why are basketball players tall?

BlogPost 104618376742 Red Badger launches CRUX - Headless app development in Rust

BlogPost 104260020512 iOS, Android and Web applications that share a single Rust core

BlogPost 103617459979 Red Badger announces launch of new digital customer onboarding journey for Security Bank

BlogPost 103676845623 Introducing CRUX

BlogPost 101371434828 ON DEMAND VIDEO - Product Impact with Split

BlogPost 101319628874 10 reasons why you should be exploring autonomous stores

BlogPost 91173617682 Engineering for ambition with Adyen

BlogPost 97803598613 Why we love Split

BlogPost 97446320730 Red Badger partners with Split.io for world class digital products

BlogPost 95861950837 Red Badger keynotes at Rust Nation 2023

BlogPost 95216989468 How to build a culture of experiential learning

BlogPost 93467109999 Red Badger partners with Adyen to bolster payment capabilities

BlogPost 91045183577 Building a Fortnum & Mason e-commerce store in two days

BlogPost 79934697887 Product strategy as your competitive advantage

BlogPost 90115504428 How enterprises create great digital products in 100 days

BlogPost 90277234815 4 steps to great digital products and a better product business

BlogPost 90268301684 100 days to #CreateGreat - Digital Products for Blue Chips

BlogPost 87213570671 Flexible work & parenting: Becoming a Badger & a dad in just 6 weeks

BlogPost 86431031212 Park life! Volunteering in the local community

BlogPost 83780715440 The Big Debate: Is the future of loyalty point-less?

BlogPost 83780715357 [Step-by-Step Guide] 5 Steps to a loyalty product your customers love

BlogPost 83767361686 Subscription is the new loyalty and other takeaways from HOSTECH 2022

BlogPost 83767361628 Why I am proud to be a Badger

BlogPost 83767079693 Meet our Loyalty Panellist: Dave Robinson from Boots

BlogPost 83765989908 Meet our Loyalty Panellist: Gianfranco Cuzziol from Natura & Co

BlogPost 83765989774 Meet our Loyalty Panellist: Candice Lott from We Are The Digital Type

BlogPost 83530504102 Point-based vs point-less: Time for loyalty to evolve?

BlogPost 83550114428 [Infographic] Is the future of loyalty point-based or point-less?

BlogPost 83024843267 Consumer Duty: how a digital mindset can solve its 6 biggest challenges

BlogPost 82863195054 Delivering a lean digital product in two weeks

BlogPost 79941304340 Writing Envoy filters in Rust with WebAssembly

BlogPost 79935463807 [Video] The Future of Digital Loyalty: Loyalty as a Service

BlogPost 79941304170 [Video] The Future of Loyalty: How Nando's meets the demands of Gen Z

BlogPost 79941304156 [On Demand Webinar] Next-gen cloud connectivity: The evolution of NATS

BlogPost 79935463805 [Video] The future of digital loyalty: loyalty according to Gen Z

BlogPost 79935463781 [White paper] Multi-cloud platforms are here

BlogPost 79941304145 How to use test automation in software development

BlogPost 79935463806 8 guiding principles for your tech strategy

BlogPost 79934697882 What loyalty leaders have to say about loyalty programmes in 2022

BlogPost 79934697872 7 key benefits of automated testing in software development

BlogPost 79941304183 Fixing climate change with digital product thinking

BlogPost 79941304138 Mission thinking: embracing an experimentation mindset

BlogPost 79941304139 Mean Time to Repair (MTTR): One of your most important metrics

BlogPost 79941304143 Fixing climate change with the circular economy and digital technology

BlogPost 79928678732 Learning to fail to deliver digital product success

BlogPost 79941304141 How to use service design for validating ideas

BlogPost 79935463787 The key advantages of using a monorepo

BlogPost 79934697985 What is Infrastructure as Code (IaC)?

BlogPost 79941304177 Microplatforms. The best enabler of continuous deployment ever

BlogPost 79941304191 Why Pipeline as Code is adding value

BlogPost 80441752204 Earning brand loyalty with the Kano Model

BlogPost 79935463783 Elevate your design thinking with sketch thinking

BlogPost 79941304332 4 key takeaways from Kanban Management Professional training

BlogPost 79941304181 One minute reads: forecasting with Little’s Law

BlogPost 79934697888 Introducing an Agile Delivery Framework to the public sector

BlogPost 79928678721 Meet our Loyalty Panellist: Robert Bates from Currys

BlogPost 78700136803 [Video] Four Reasons Digital Natives Create More Loyal Customers

BlogPost 79941304148 Subscription is the new loyalty and other takeaways from HOSTECH 2022

BlogPost 79935463789 Be a force multiplier

BlogPost 79941304155 Transforming blue chips into next generation Digital Product companies

BlogPost 95847203339 Red Badger wins Business Reporter's 2022 Digital Leader Award

BlogPost 79928678730 How service design is helping Anthony Nolan to simplify time-to-transplant

BlogPost 83989299274 [On Demand] Here's why we love WebAssembly (outside of the browser)

BlogPost 79935463778 A truly resilient multi-cloud platform with wasmCloud and WebAssembly

BlogPost 79941304132 LGBTQ+ History month: Championing our favourite tech heroes

BlogPost 79941304151 Secure your business: how to protect yourself from the next Log4j

BlogPost 79941304140 Slay corporate risk, innovate faster

BlogPost 79941304154 7 steps to perfect retrospectives to align teams on shared values

BlogPost 79928678731 A product transformation mindset to tackle social inequality

BlogPost 79941304134 How Gen Z think about loyalty and why you need to align your strategy

BlogPost 79935463784 Building a digital product organisation to tackle social inequality

BlogPost 79928678726 Pride 2021 & the Red Badger Social Value Taskforce

BlogPost 79941304194 WebAssembly: The days of cloud vendor lock-in are over

BlogPost 79928678714 Align and integrate: how to cultivate loyal guests

BlogPost 79928678720 Standing out from the crowd: creating memorable customer experiences in retail

BlogPost 79941304171 How hotels can own their guest experience

BlogPost 79941304130 The key to overcoming poor guest experience in Hospitality

BlogPost 79935463785 How to build loyalty programmes retail customers actually want

BlogPost 79941304126 Start small but think big: how to build a digital roadmap

BlogPost 79934697873 How to measure psychological safety

BlogPost 79941304135 New product development in a brave new world

BlogPost 79941304147 Desirability testing: Innovation at the British Heart Foundation

BlogPost 79928678719 Understanding burnout and anxiety - Lunch & Learn by Spill

BlogPost 79934697871 Can API Products help grow your customer base?

BlogPost 83788175442 How Gen Z think about loyalty and why you need to align your strategy

BlogPost 79935463795 How to launch a scalable optimisation programme for digital products

BlogPost 79934697909 How product thinking can help solve society’s grand challenges

BlogPost 79941304167 6 ways to build an unproductive product team

BlogPost 79934697885 Teaching people with special needs how to code

BlogPost 79935463813 How to talk about race and diversity?

BlogPost 79935463770 Designing for complexity: Delivery Framework for the Government

BlogPost 79935463808 Introducing the remote North Star Framework

BlogPost 79934697886 Successfully introducing User Experience Design (UXD) from scratch

BlogPost 79935463786 UX Design: Getting user feedback into the backlog

BlogPost 79935463811 Working in the open with the FutureNHS platform

BlogPost 79928678718 Mission Beyond Q&A with Matthew Syed on cognitive diversity

BlogPost 79941304335 Validating product ideas using the RAT

BlogPost 79941304179 Lift off! The launch of Mission Beyond

BlogPost 79935463788 Strategy for developing digital products

BlogPost 79941304159 Putting purpose at the heart of business

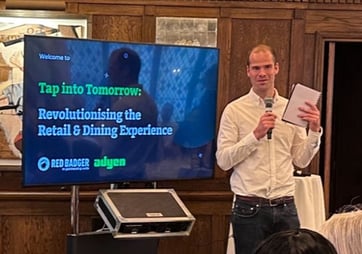

The event offered a fantastic networking opportunity for delegates across the Enterprise Retail and Hospitality sectors to connect and discuss the future of Product Design and Digital Product Development over coffee and delicious pastries. Red Badger's Business Development Director, Jimmy Taylor hosted and introduced Adyen, shedding light on our ongoing partnership and outlining the focus of the event. But the highlight was undoubtedly the case study presented by Sweaty Betty. They offered an in-depth look at how they've successfully implemented 'Tap to Pay' technology in their stores.

The event offered a fantastic networking opportunity for delegates across the Enterprise Retail and Hospitality sectors to connect and discuss the future of Product Design and Digital Product Development over coffee and delicious pastries. Red Badger's Business Development Director, Jimmy Taylor hosted and introduced Adyen, shedding light on our ongoing partnership and outlining the focus of the event. But the highlight was undoubtedly the case study presented by Sweaty Betty. They offered an in-depth look at how they've successfully implemented 'Tap to Pay' technology in their stores.

About Adyen

About Adyen

Add a Comment: